Learn how auto-adjusting your policy helps you save

Meet Thandi 👋

Thandi took out EasyProtect Life Cover of R 1,200,000.00 for 5 years, in January.

We took into account both Thandi’s assets and Easy Portfolio values at the time, and subtracted this from the total life cover required by her dependants.

Required Cover

R 2,250,000.00

LESS ASSETS

Easy Portfolio

- R 1,000,000.00

Additional Assets

- R 50,000.00

NET COVER REQUIRED

R 1,200,000.00

THANDI PAYS

R 109.99 p/m

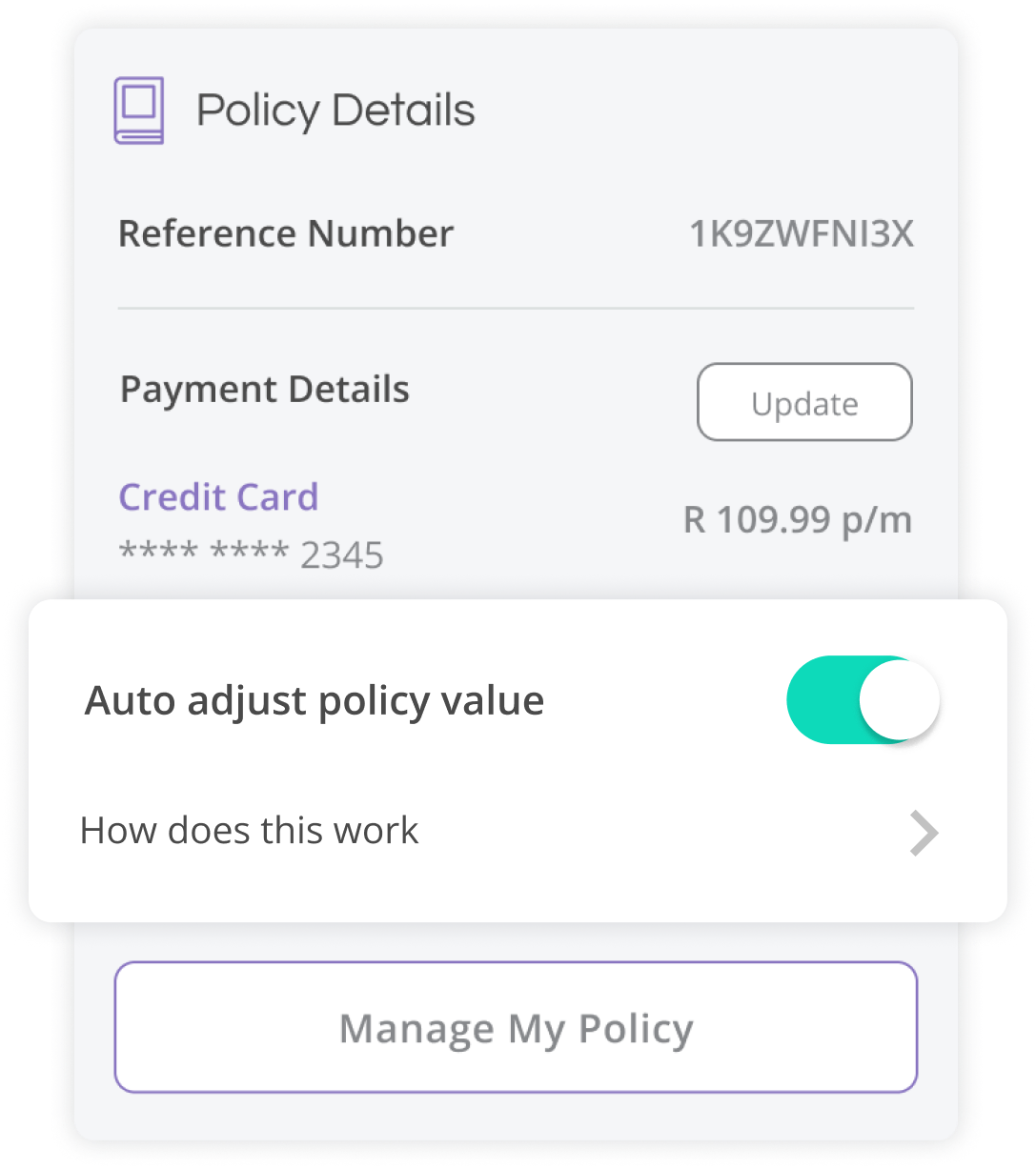

Once her life cover was active, Thandi was given the option to auto adjust her policy value ✅

Once her life cover was active, Thandi was given the option to auto adjust her policy value ✅

What does this mean for Thandi?

After a period of 6 months, Thandi’s Easy Portfolio will be re-evaluated. If the value of her investments and assets has increased, her life insurance requirement decreases accordingly. This means she will get a savings portion on her policy value too - Hooray! 👏

6 months later...🗓️

Thandi’s Easy Portfolio has grown since the last evaluation and so her life cover requirement decreased to R 1,100,000

Because auto-adjust was enabled, Thandi’s premium remained the same, but she earned a savings portion of R 9.50 which was automatically deposited straight into her ZAR account to invest further.

SAVING OPTIONS

R 9.50

Required Cover

R 2,250,000.00

LESS ASSETS

Easy Portfolio

- R 1,100,000.00

Additional Assets

- R 50,000.00

NET COVER REQUIRED

R 1,100,000.00

THANDI PAYS

R 109.99 p/m

Thandi is happy and content knowing she can further invest in her future. 😊

Thandi is happy and content knowing she can further invest in her future. 😊

Frequently Asked Questions

-

What is Auto-Adjust

As your assets grow over time, the amount of cover you need decreases. If you choose to auto-adjust your cover, we will update your cover to your new required amount after assets, every 6 months. As your policy cost decreases the excess will be yours to invest.

-

Can I switch Auto-Adjust off at anytime?

Yes, you can! Like you toggle Auto-Adjust on, you can toggle Auto-Adjust off. When Auto-Adjust is toggled off, your life cover remains as set and will only update when done manually yourself.

-

What happens if my EasyPortfolio decreases over 6 months

Auto-adjust is aimed to help you grow your investments. If your portfolio remains the same or decreases, your cover amount stays the same and so no savings portion will exist.