Life insurance that’s built for investors like you

Life insurance that rewards good investment behaviour through cheaper premiums. It’s also asset aware, giving you the option to decrease your cover as your wealth increases.

Get A Quote

Life insurance that rewards good investment behaviour through cheaper premiums. It’s also asset aware, giving you the option to decrease your cover as your wealth increases.

Get A QuoteLife Insurance for Investors

Our term life insurance exists to make sure that those closest to you are financially protected if you pass away. Its purpose is to give your family financial support for necessities like continuing their education and staying in their current house should you no longer be around to do so.

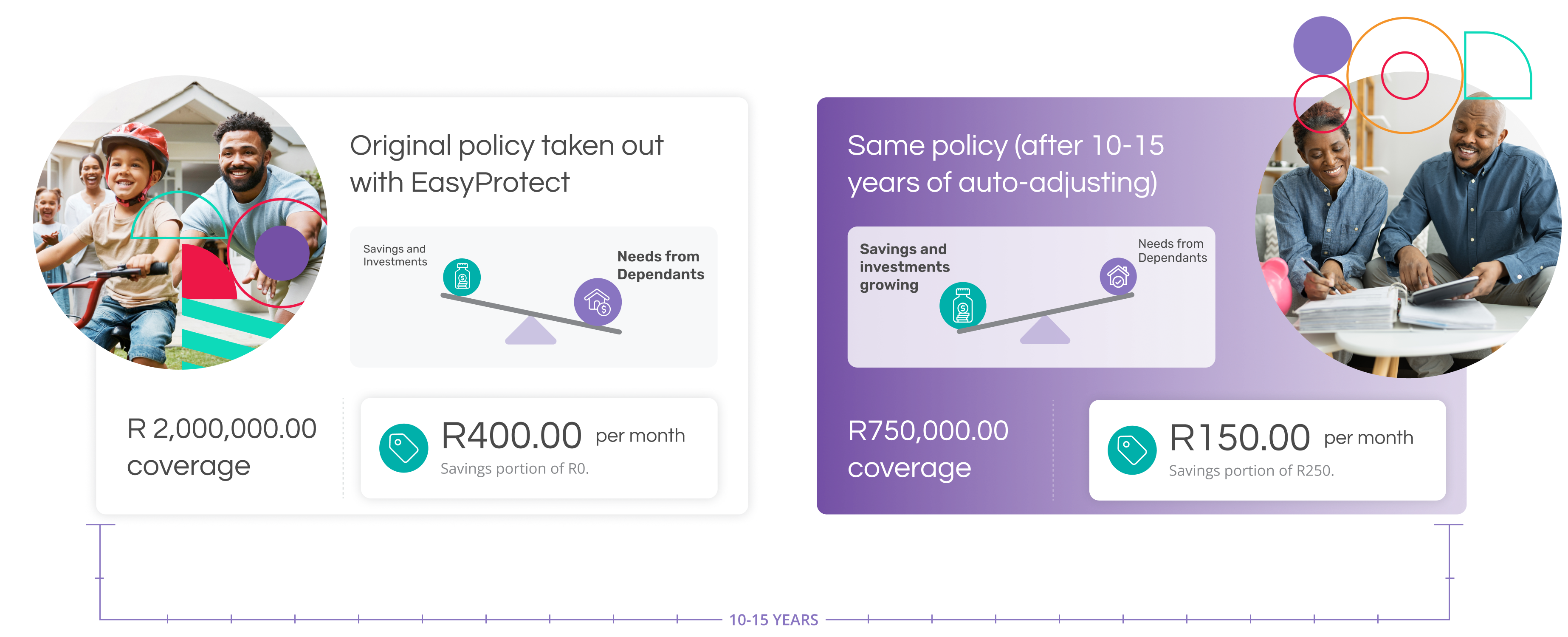

Investors are already on a journey to grow their assets and wealth, which in time could service these liabilities sufficiently enough to not need life insurance at all. But this takes time. So while you are growing your portfolio, EasyProtect is the gap filler between what you have (your assets) and what you need to cover (your liabilities).

You need to be between the ages of 18 and 50 and in generally good health to apply. We are working on making EasyProtect available to even more of our clients as soon as possible.

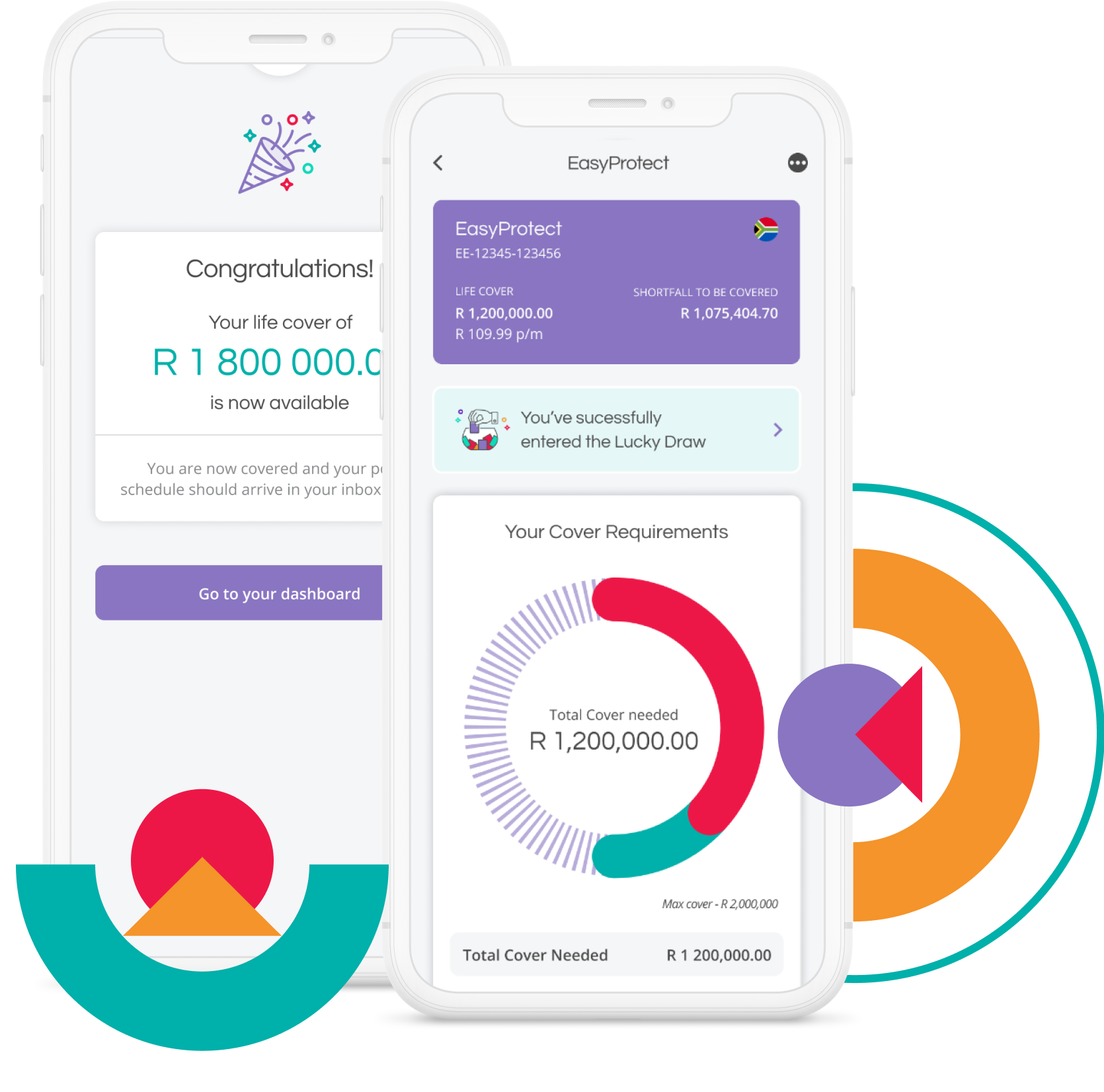

Fully digital

No medical exams

Same-day coverage

Affordable

Asset Aware

Personalized

WHAT MAKES US DIFFERENT?

EasyProtect rewards good investment behaviour with cheaper premiums and higher cover amounts !

Save up to 50% on your monthly premium

EasyProtect tracks your assets to offer auto-adjustment on your premiums

EasyProtect is asset-aware, which means that as your assets or investments grow, your gap and the dependency on life insurance reduces. The gap you are covered for will be reassessed every six months, based on your EasyEquities assets, and you will have the choice to adjust your cover amount should you wish to do so. If your premium reduces, the saving will be deposited into your EasyEquities ZAR Wallet to invest.

.png)

Why Choose EasyProtect?

Get piece of mind with same day affordable cover to secure your loved ones future.

Built in funeral cover. Get peace of mind knowing that if the worst happens, your family receives up to R50,000 of your claim within 2 days of submitting required documents.

Our policies are affordable and start with at as little as R20 per month, depending on the amount of cover and the outcome of your assessment.

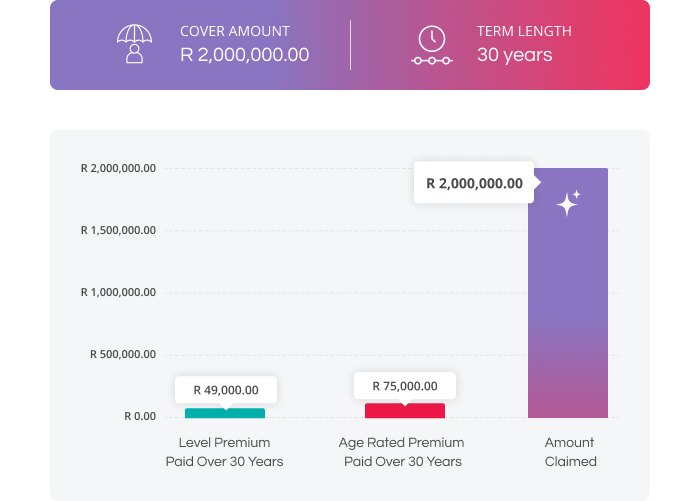

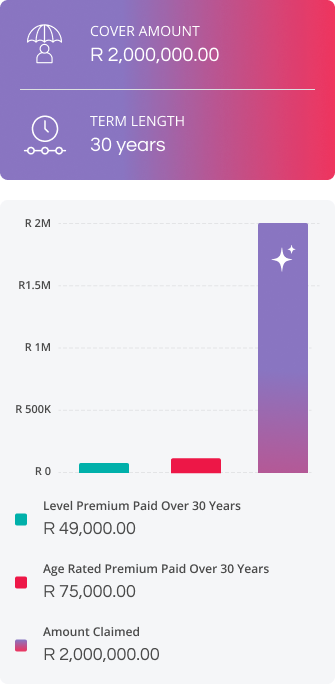

Premium choice. We offer you the flexibility to opt for age-adjusted premiums, that start low and gradually increase with age to reflect risk, or level premiums, which remain fixed for the entire policy term.

No medical checks. You will only have to answer a hand full of questions about your health and way of life.

You're in good hands. Our term life insurance is provided by the experienced team at Sanlam.

The Power of Life Insurance

Claims payments quite literally dwarf your premiums paid! That's the power of life insurance. EasyProtect gives you the option to choose between level premiums (guaranteed to not go up) or age rated (start low and gradually increase with age) - Your choice. Either way, you can enjoy piece of mind, knowing your loved ones future is secured.

HOW DO PREMIUMS AND CLAIMS COMPARE?

Take a look at the graph below to see how age rated and level premiums compared to a claim paid over a 30 year period.

-

Who can apply?

Applicants must be between the ages of 18 and 50 and in generally good health. You might not be qualified for a coverage at this time if you have a history of heart disease, cancer, or other serious illnesses.

-

Can I cancel any time?

Yes, you can! If you decide to cancel during the first 31 days, you'll receive a full refund. We'll cease charging after that.

-

No medical exam?

That is correct! You'll need to answer a few questions about your health and way of life as part of your sign up. Your answers allow us to save you time and avoid offline medical exams.

-

Term life vs Whole life

Term life insurance protects you for a set period of time, while whole life insurance offers lifetime protection.

-

Why EasyProtect?

EasyProtect is asset-aware life insurance that rewards good investment behaviour. Good investment behaviour is rewarded with lower premiums and increased cover. As your assets or investments grow over time, your dependency on life cover reduces. Our innovative solution recalculates your required cover and adjusts your premiums accordingly, sweeping the excess into your EasyEquities account to continue growing your portfolio.